What is the SSDI Payment Schedule?

Until 1997, Social Security benefits were paid on the 3rd of each month. That was true whether you were receiving retirement benefits or Social Security disability benefits (SSDI). Now, the date that your disability pay arrives depends on the type of benefit you receive and your birth date.

The Social Security Administration (SSA) processes payments for several different programs. A disabled person may receive SSDI, Supplemental Security Income (SSI) or both. SSDI benefits are based on your work history, just like your Social Security retirement benefits. SSI is a needs-based program that is administered by the SSA but is funded separately.

Here’s what you can expect if you are receiving SSDI, SSI or both.

SSDI Disability Payment Schedule

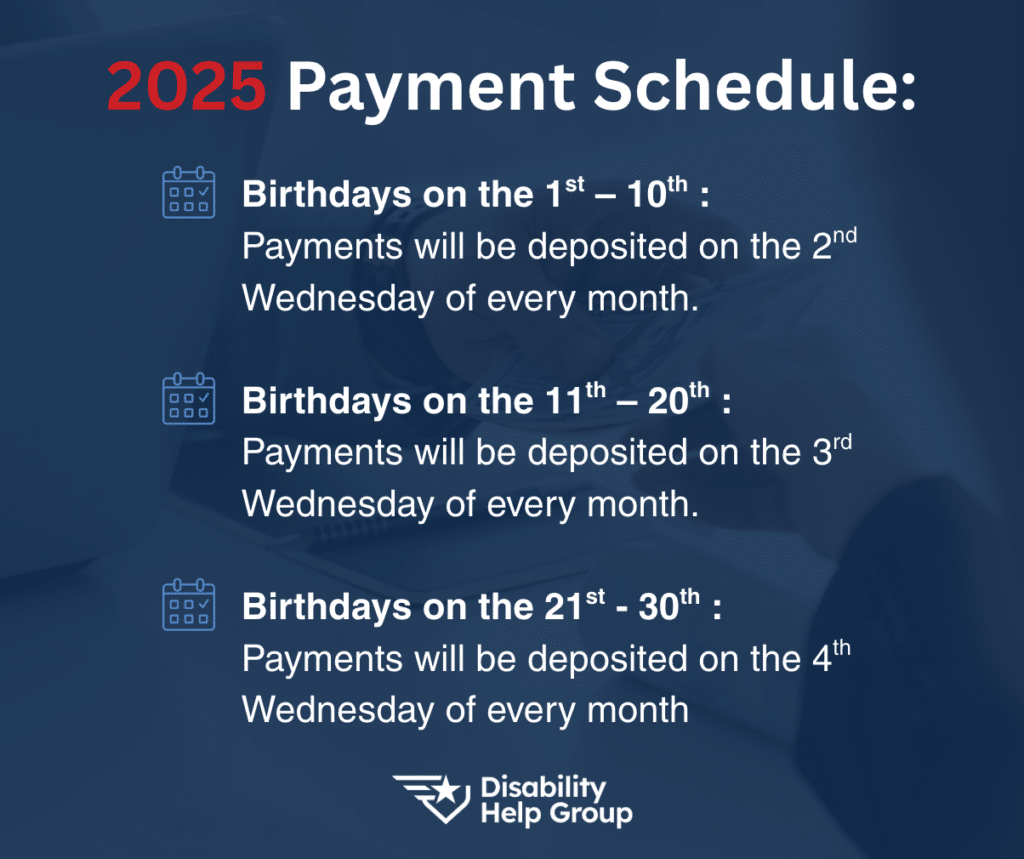

If you started receiving SSDI benefits after 1997, your birthday will determine the date you receive your payment. Under the current Social Security disability payment schedule, f your birthday falls between:

- 1st-10th of a month, SSDI checks or direct deposit will arrive on the second Wednesday of every month.

- 11th-20th of a month, SSDI checks or direct deposit will arrive on the third Wednesday of every month.

- 21st-31st of a month, SSDI checks or direct deposit will arrive on the fourth Wednesday of every month.

If you received benefits before 1997, your SSDI payment date will be on the third day of the month. It does not matter what day your birthday falls on.

SSI Payment Schedule

While SSDI payment dates are spread throughout the month based on your birth date, all SSI payments are made on the same date: the first day of the month. If you receive both SSI and SSDI, your payments will be made separately.

How Does the SSA Treat Weekends and Holidays?

Since most SSDI payment dates fall on Wednesdays, that payment schedule is generally not disrupted by federal holidays, and those dates obviously never fall on Saturday or Sunday. That’s not true for SSI payments, which are scheduled for the first of the month, nor for those SSDI payments that are made on the third day of the month.

When the first or third day of the month falls on a Saturday, Sunday or holiday, those payments are made on the last regular business day before the scheduled payment date. When this happens, the recipient may get two SSI payments or SSDI payments in the same calendar month and then none in the subsequent month. For example, in 2025 SSI recipients will receive one payment on August 1 and another on August 29th. That’s because the 30th and 31s of August fall on Saturday and Sunday, and September 1 is Labor Day.

SSDI and SSI Combined Payments Schedule

If you receive SSDI and SSI payments together, you will receive your SSI payment on the first day of the month and your SSDI payment on the third of the month.

How Long Does it Take to Receive SSDI Payments?

How long it takes to receive your monthly benefits and back pay after you’ve been approved for SSDI benefits varies. Most recipients start getting benefits one to two months after approval, and back pay usually arrives during that same time frame. But, the SSA says it may take three to five months to receive back pay, and some claimants report receiving it within just a few weeks.

If you apply for SSDI immediately upon becoming disabled and your claim is approved quickly, you may have to wait a little longer. That’s because there is a five month waiting period between onset of your disability and the time you become eligible for benefits. So, for example, if you become disabled in January and are approved for benefits in April, you’ll have to wait a few months for your benefits to kick in.

You won’t have to guess at this, though. Your SSDI award letter will include a “date of entitlement,” which is the first month you will be eligible to receive benefits. If you don’t start receiving benefits on schedule, you should contact the SSA for help.

How to Receive Your SSDI and SSI Payments

Social Security offers several ways to send your SSDI or SSI payments.

For example:

- Direct Deposit, which is probably the safest way to receive your disability payments since they cannot be lost or stolen if deposited directly into your bank account.

- The Direct Express Card program, which credits money directly to a swipe-able card.

SSDI recipients can still receive their payments by mail. It is better to receive payments through one of Social Security’s preferred methods to avoid the possibility of lost or stolen checks. Social Security asks that you not contact them about lost checks until the fourth day after the first of the month. SSI recipients must receive their funds electronically, using one of the two bulleted options above.

Tax on Social Security Benefits

You may have to pay taxes on your Social Security benefit, depending on your income level. In 2025, SSDI income–like Social Security retirement income–is only taxable when the total of your other income plus 50% of your Social Security income exceeds a certain threshold. The applicable cut-offs are:

- $25,000 if your tax filing status is single, head of household, qualifying surviving spouse, or married filing separately and have lived apart from your spouse for the full year

- $32,000 for married couples filing jointly

- $0 for married couples filing separately who lived together at any point during the tax year

SSI income is not taxable.

Social Security doesn’t automatically withhold taxes, but does offer voluntary tax withholding from your benefit. You can choose this option by completing Form W-4V. There are specific percentages to choose from. You can obtain the form from Social Security, request it from the IRS, or ask your representative for a copy.

Generally, you would receive a refund when filing taxes the following year if you opted to voluntarily have taxes withheld and you overpaid.

Call Now for a Free Case Review, (800) 800-3332

Make sure you start your claim the right way and apply for all the benefits you deserve. Contact us here to receive a FREE consultation.